Notice: The trading of this cryptocurrency is currently not supported on OKX. Continue trading with cryptocurrencies listed on OKX.

HYPE

Hyperliquid price

$48.32

-$1.417

(-2.85%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

Hyperliquid Feed

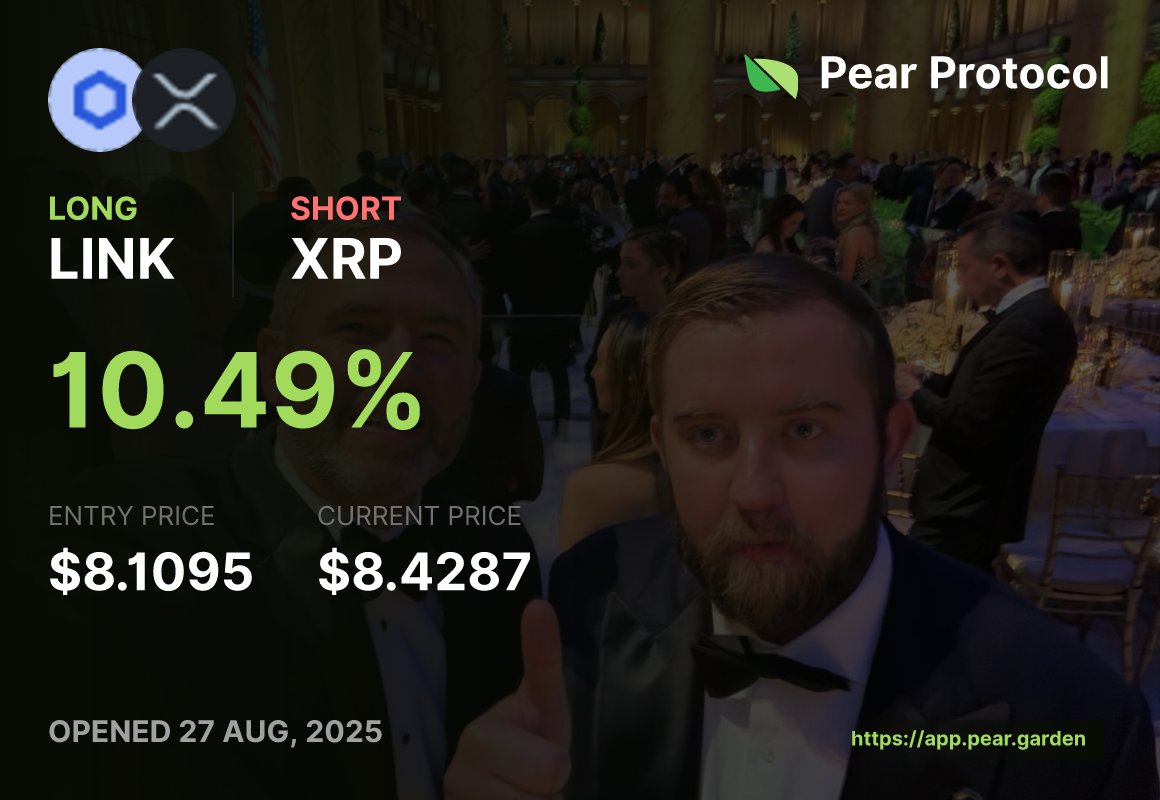

The following content is sourced from .

An in-depth analysis of the Hyperliquid project

Hyperliquid has risen rapidly in the decentralized finance (DeFi) space, becoming a leader in the DeFi market in 2025 with its high-performance Layer 1 blockchain and innovative model focused on perpetual contract trading. The platform redefines the standards of decentralized trading with its exceptional trading volume, revenue performance, and technical architecture.

Business performance: A frontrunner in the DeFi market

Revenue performance was strong

In July 2025, Hyperliquid captured about 35% of the total revenue of blockchain protocols, ranking third in the industry behind stablecoin issuers Tether and Circle. Its 30-day revenue reached $95.63 million, and annualized revenue is expected to be as high as $1.167 billion. This achievement stems from its strong competitiveness in the perpetual contract trading market. Perpetual contracts, as highly leveraged, highly liquid financial instruments, attract a large number of professional traders and retail users, and Hyperliquid's low fees and high efficiency make it a preferred platform.

Trading volume and market dominance

Hyperliquid dominates the decentralized perpetual contract exchange (DEX) market, with data from June 2025 showing a 63% market share in 24-hour trading volume and a market share of over 74% in perpetual contracts. The cumulative trading volume has exceeded $375 billion, and the total deposit size has exceeded $4.8 billion, reflecting the high user stickiness and market depth.

Its no-KYC (Know Your Customer) access mechanism, centralized exchange-like user interface, and low transaction costs attract traders worldwide. The platform supports high-frequency trading and complex order types (e.g., limit orders, stop orders), further solidifying its position in the specialized trading market.

Technology at its core: Hyperliquid's competitive advantage

The success of Hyperliquid is inseparable from its underlying technical architecture, which is analyzed in depth from three aspects: blockchain design, token economy, and ecological expansion.

Hyperliquid L1 and HyperBFT consensus mechanism

Hyperliquid operates on a self-developed Layer 1 blockchain and uses the HyperBFT (Byzantine Fault Tolerance) consensus algorithm, optimized for high-frequency trading scenarios. The algorithm combines Practical Byzantine Fault Tolerance (PBFT) with efficient batch processing technology, capable of processing 200,000 orders per second with a median latency of just 0.2 seconds, comparable to centralized exchanges while retaining the transparency and security of decentralization.

The core strength of HyperBFT lies in its parallel transaction processing capabilities and low-latency order matching. The platform ensures fast execution and low slippage even in highly volatile markets through sharded order book management and on-chain settlement. Additionally, Hyperliquid adopts a gasless trading model, embedding fees into transaction spreads, significantly reducing user costs and enhancing the trading experience. This architecture is particularly suitable for the perpetual contract market's demanding requirements for real-time and throughput.

HYPE Token: The Backbone of the Economic Model

The HYPE token is the core driving force of the Hyperliquid ecosystem. Since the genesis airdrop in late 2024, the price of HYPE has risen from $3.9 to $41.05 in July 2025, with a market capitalization of approximately $7.22 billion, ranking 11th in the crypto market. HYPE is not only used to pay for transaction fee discounts and governance decisions (through the Hyperliquid Improvement Proposal, HIP) but will also support staking rewards in the future.

Hyperliquid's HIP-1 token listing mechanism further reinforces HYPE's value. The project team determines the token listing fee through market bidding (which has recently stabilized above $100,000), and all fees are used to buy back and burn HYPE, creating a deflationary effect. This mechanism not only enhances token scarcity but also ensures that platform revenue directly feeds back to the ecosystem, enhancing long-term economic sustainability. Hyperliquid's self-funded and venture capital rejection model further ensures that its economic model is centered on user interests.

HyperEVM: Towards an all-round DeFi ecosystem

Hyperliquid's upcoming HyperEVM, an Ethereum Virtual Machine compatible scaling layer, is currently in the testnet phase and supports Solidity smart contract development. More than 30 projects are already planned to be deployed on HyperEVM, including automated market makers (AMMs), lending protocols, and yield farming platforms. HyperEVM leverages the high throughput of Hyperliquid L1 to provide a low-cost, high-speed transaction experience that is more competitive with the congestion and high gas fees of the Ethereum mainnet.

HyperEVM's unique advantage lies in its native integration with the Hyperliquid perpetual contract marketplace. Developers can build innovative applications that combine derivatives trading, such as leveraged lending based on perpetual contracts or synthetic asset trading. This combination of "transactions + smart contracts" positions Hyperliquid poised to transform from a single perpetual contract platform to a comprehensive DeFi ecosystem, competing with Ethereum, Solana, and others.

Strategic innovation: differentiated market positioning

Hyperliquid's strategy focuses on the perpetual contract market, a segment that has become a popular track for crypto trading due to its high leverage and high liquidity. The platform's 74% market share in perpetual contracts far surpasses competitors such as dYdX and GMX, highlighting its precise market positioning. Perpetual contracts allow traders to hold positions indefinitely, making them suitable for the highly volatile crypto market, while Hyperliquid's low latency and deep liquidity make it a preferred choice for professional traders.

The platform's UX design borrows from centralized exchanges like Binance, offering an intuitive interface and robust order functionality while maintaining transparency in decentralization. The no-KYC requirement further lowers the barrier to entry, attracting over 185,000 unique users (as of the end of 2024). Through a differentiated strategy, Hyperliquid avoids direct competition with AMM-type DEXs (such as Uniswap) and focuses on high-frequency trading and derivatives markets, establishing unique competitive barriers.

HIP-1's token listing mechanism is another strategic highlight. Through market-based pricing, Hyperliquid ensures the quality of newly listed tokens and avoids the proliferation of illiquid assets. This mechanism not only enhances the credibility of the platform but also injects a stable revenue stream into the ecosystem and supports long-term development.

Future potential analysis

The future blueprint for Hyperliquid is clear and ambitious. HyperEVM's mainnet launch, expected in 2026, will transform it from a single trading platform to a comprehensive DeFi ecosystem, supporting diverse applications from derivatives to lending. For example, HyperEVM-based protocols may launch innovative products that incorporate perpetual contracts, such as leveraged decentralized insurance or on-chain options markets.

The upcoming HIP-3 upgrade will introduce staking and lending features, further enriching the ecosystem. The staking mechanism will allow HYPE holders to participate in network security and earn yields, enhancing the token's long-term holding appeal. Lending protocols can support margin trading with low capital requirements, attracting more small and medium-sized traders. These expansions will allow Hyperliquid to capture a broader share of the DeFi market.

Additionally, Hyperliquid's high-performance architecture gives it potential to venture into emerging sectors such as real-world asset tokenization (RWA) and institutional-grade derivatives trading. As DeFi converges into traditional finance, its low-latency, high-throughput infrastructure will be a significant advantage for institutional users.

About Hyperliquid (HYPE)

- Official website

- Github

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Latest news about Hyperliquid (HYPE)

Hyperliquid’s HYPE Hits Record High Above $50 on Trading Boom, Token Buybacks

Analysts highlight Hyperliquid's strong fundamentals but caution about potential risks from scheduled token unlocks and its high valuation.

28 Aug 2025|CoinDesk

XPL Futures on Hyperliquid See $130M Wiped Out Ahead of the Plasma Token's Launch

Open interest on Hyperliquid’s XPL market plunged from $160 million to $30 million in minutes as a trader-triggered price spike caused mass auto-deleveraging.

27 Aug 2025|CoinDesk

WLFI Futures Tumble 44% on Debut as Traders Short the Trump-Linked Token

Traders piled into short positions against WLFI as the Trump-linked DeFi token debuted on Hyperliquid, sending its price tumbling more than 44% in hours.

26 Aug 2025|CoinDesk

Learn more about Hyperliquid (HYPE)

What is Hyperliquid: the perpetual DEX HYPE behind HyperEVM

As one of the hallmark achievements in the crypto space, DEXs have transformed how crypto users engage with trading digital assets. Unlike their traditional centralized counterparts, DEXs pride themse

25 Jul 2025|OKX|

Beginners

Hyperliquid Wallet: How Whale Manipulation Triggered a 200% XPL Price Surge

Introduction to Hyperliquid Wallet and Whale Activity The cryptocurrency market is no stranger to dramatic price movements, but the recent activity surrounding the Hyperliquid wallet has sparked wides

28 Aug 2025|OKX

Hyperliquid HYPE Cryptocurrency: Unveiling the Next-Gen Blockchain Revolution

What is Hyperliquid HYPE Cryptocurrency? Hyperliquid HYPE cryptocurrency is revolutionizing the blockchain and decentralized finance (DeFi) landscape with its cutting-edge Layer-1 blockchain technolog

27 Aug 2025|OKX

HYPE and ETH Address: Exploring Hyperliquid's Blockchain Revolution

What is Hyperliquid (HYPE) and Why Does It Matter? Hyperliquid (HYPE) is a next-generation Layer-1 blockchain designed to deliver unmatched transaction speeds and scalability. Capable of processing up

27 Aug 2025|OKX

Hyperliquid FAQ

How much is 1 Hyperliquid worth today?

Currently, one Hyperliquid is worth $48.32. For answers and insight into Hyperliquid's price action, you're in the right place. Explore the latest Hyperliquid charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Hyperliquid, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Hyperliquid have been created as well.

Will the price of Hyperliquid go up today?

Check out our Hyperliquid price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials