$SOL está infravalorado, $SOL supera a $ETH

THIS POST IS FOR $SOL HOLDERS.

We’ve seen this before:

– $BTC pumped → ETF + institutional inflow

– $ETH pumped → ETF + institutional inflow

Now? → $SOL & $LTC (Next ETF approve)

Since then I’ve been thinking about @solana a lot. It might seem quiet these days, but I just loaded my $SOL bag again.

The real question is: are we underestimating how much $SOL has already won?

Because if you step back, $SOL isn’t in a speculative phase anymore.

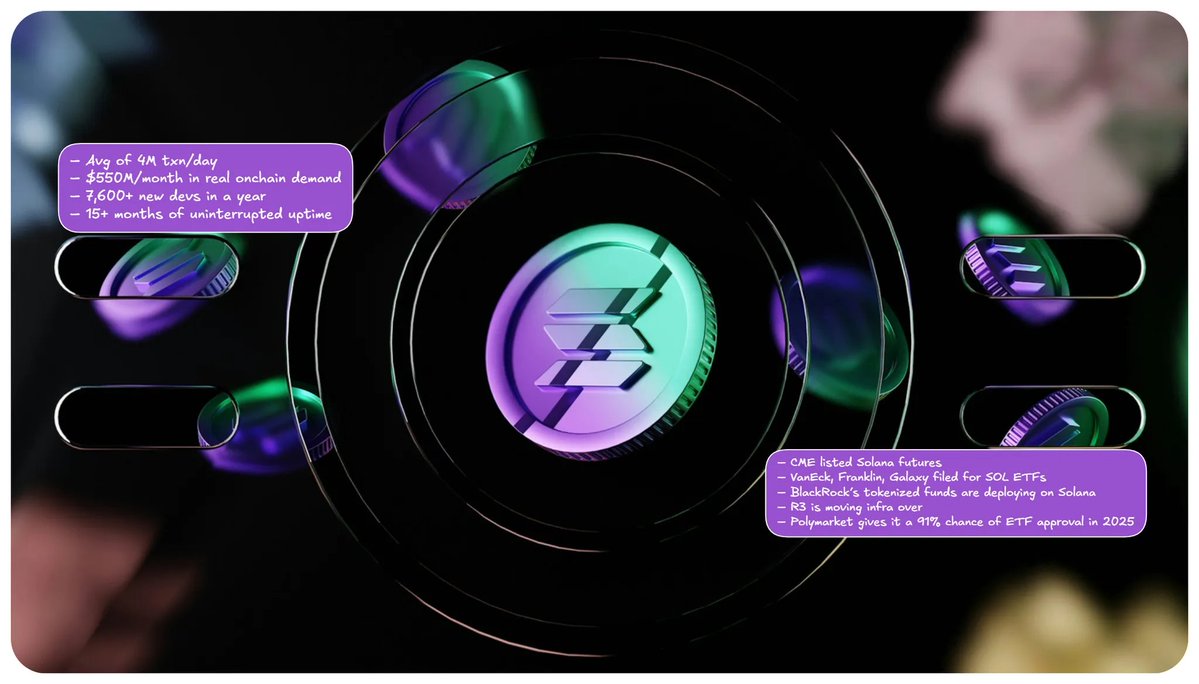

It’s already doing:

– More daily txs than every other chain combined with avg of 4M

– $550M/month in real onchain demand

– More DEX volume than Ethereum

– They’ve got 7,600+ new devs in a year

– A mobile stack scaling globally

– A booming MEV economy via Jito

– RWAs, DeFi, AI… all gaining traction on Solana first

– 15+ months of uninterrupted uptime

– And still charges less than a penny per tx

That’s production-grade infra, and it’s not just retail either. Institutions are creeping in:

– CME listed Solana futures

– VanEck, Franklin, Galaxy filed for SOL ETFs

– BlackRock’s tokenized funds are deploying on Solana

– Even R3 (the enterprise infra giant) is moving infra over

To add to the context, Polymarket gives it a 91% chance of ETF approval in 2025.

You might fade a scarcity setup that’s easy to miss.

– SOL burns fees, reducing supply over time

– and as on-chain demand rises, so does the burn rate

– pair that with long-term staking + institutional cold storage

→ You get the setup: rising demand, tightening float, and a price chart that might just snap

If you told someone in 2022, post-FTX + SOL at $10, that this would happen in 18 months, they’d laugh.

But it did quietly so now I’m asking myself: what happens if a spot ETF gets approved? What happens if Firedancer ships 1M TPS in Q4?

I’m not saying $SOL is guaranteed to hit $500.

But it doesn’t need to be a meme to run that far. It just needs to keep doing what it’s already doing.

Fast, stable, adopted, and now… legitimized.

Feels like the market still hasn’t priced in how real that is, this is one of those trades you don’t overthink.

15,71 mil

79

El contenido de esta página lo proporcionan terceros. A menos que se indique lo contrario, OKX no es el autor de los artículos citados y no reclama ningún derecho de autor sobre los materiales. El contenido se proporciona únicamente con fines informativos y no representa las opiniones de OKX. No pretende ser un respaldo de ningún tipo y no debe ser considerado como un consejo de inversión o una solicitud para comprar o vender activos digitales. En la medida en que la IA generativa se utiliza para proporcionar resúmenes u otra información, dicho contenido generado por IA puede ser inexacto o incoherente. Lee el artículo vinculado para obtener más detalles e información. OKX no es responsable del contenido alojado en sitios de terceros. El holding de activos digitales, incluyendo stablecoins y NFT, implican un alto grado de riesgo y pueden fluctuar en gran medida. Debes considerar cuidadosamente si el trading o holding de activos digitales es adecuado para ti a la luz de tu situación financiera.