Original | Odaily Planet Daily (@OdailyChina)

Author|Golem(@web 3_golem)

On the evening of August 22, Fed Chair Powell's last appearance during his tenure in Jackson Hole's speech opened the door for a resumption of rate cuts, with the last rate cut announced by Powell occurring on December 18, 2024. The market immediately responded positively. The three major U.S. stock indexes collectively closed higher, with the Dow Jones Industrial Average closing up 1.89%, the S&P 500 up 1.52%, and the Nasdaq Composite Index up 1.88%. At the same time, many stocks in the U.S. crypto sector rebounded and rose, with SharpLink up 15.69%, Bitmine up 12.07%, Coinbase up 6.52%, CIrcle up 2.46%, and Strategy up 6.09%.

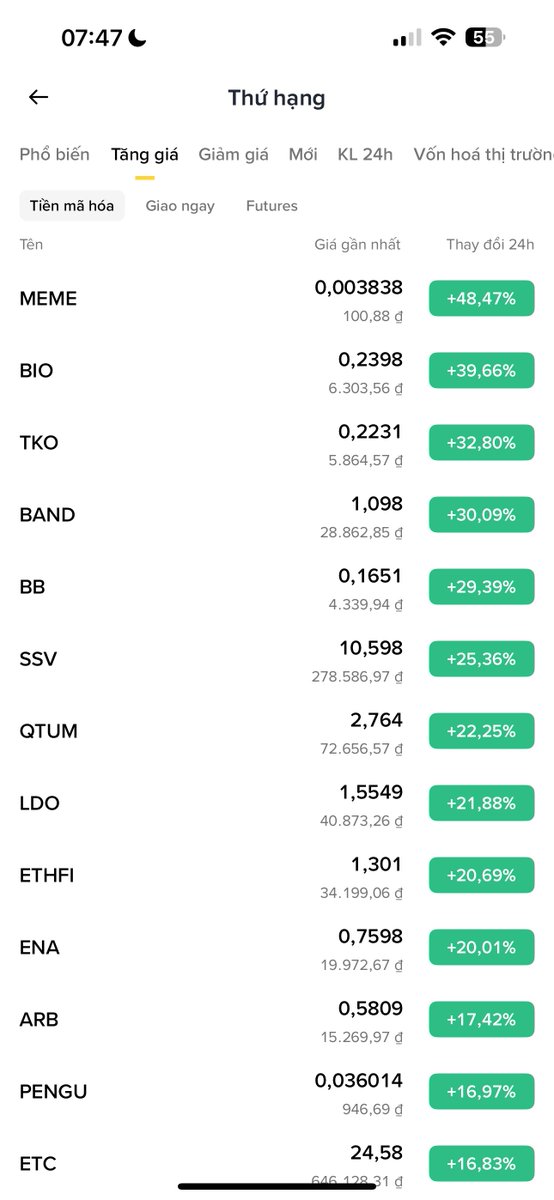

The crypto market has also performed well, with the total market capitalization of the cryptocurrency market returning to $4.1 trillion, mainly driven by the Ethereum system. On August 22, ETH rose by more than 14.33%, reaching a high of $4,887.5, hitting a record high after 3 years and 9 months. At the same time, affected by ETH's new high, many ETH Layer 2, staking, infrastructure and other track tokens have achieved general gains, with SSV 24 H up more than 25.54%, ETHFI 24 H up 20.67%, ENA 24 H up 17.58%, and ARB 24 H up 9.53%.

According to Coinglass data, ETH liquidation in the past 24 hours has surpassed BTC, with the main short order ($368 million).

Powell's dovish speech sparked a market frenzy

The market is expecting the Fed to cut interest rates to stimulate the economy in 2025, but since January, Powell has not revealed the slightest signal of interest rate cuts in every public speech. In the face of Powell's "dead carry", the most anxious thing is US President Trump, who has been pressuring Powell to cut interest rates since he officially took office this year, and finally announced that he would fire Powell.

However, the Fed has also been "cornered" this year, on the one hand, Trump's tariff policy may bring upward pressure on prices and intensify inflation; On the other hand, there are signs of a cooling labor market. If interest rates are raised to stabilize inflation, it may lead to a surge in interest rates and trigger a "financial panic", but if the Fed cuts interest rates too early to stimulate the economy, inflation expectations may spiral out of control.

Under this dilemma, more people expect Powell to remain hawkish, and BitMEX co-founder Arthur Hayes even expects Powell to become "Volcker 2.0" (Odaily Note: Volcker was the chairman of the Federal Reserve in the 70s and 80s of the 20th century, and during his tenure, he reversed the high inflation crisis with extremely hawkish monetary policy and thus rebuilt the Fed's prestige and independence).

However, Powell's speech on the evening of August 22 gave the market a big surprise, and the probability of a 25 basis point rate cut by the Fed in September rose directly to 91.1% from 75.5% before Powell's speech. In his speech, Powell said that "given that the labor market is not particularly tight and faces increasing downside risks, such an outcome (of continued rise inflation) seems unlikely" and directly stated that "preemptive action may be necessary if a tight labor market poses a risk to price stability."

These comments are proof that Powell is turning dovish, expecting the inflationary effect of tariffs to fade and a weak labor market that will push the Fed to cut interest rates to support a weakening job market.

Powell's shift caused great frenzy in the market, which became the main driving force for ETH's daily rise of more than 10%. Despite this, the arrogant Trump still sarcastically said after Powell's speech, "Powell should have cut interest rates a year ago, and now it is too late to signal a rate cut."

What is the future of ETH?

As ETH rises, Ethereum's market capitalization has surpassed payment giant Mastercard to rank 26th in the world by market capitalization. Yesterday, ETH rose more than 10% on a daily basis and briefly broke through a new high, in addition to Powell's dovish speech, there is a view that the direct reason for ETH's breakthrough to a new high is actually the market short squeeze, so after the brief sentiment lands, how should the ETH market go?

Many remain optimistic. Tom Lee posted after Powell's speech that Powell's speech was interpreted as dovish, which was in line with expectations and was positive for cryptocurrencies (BTC, ETH). Yi Lihua, founder of "e Marshal" Liquid Capital (formerly LD Capital), also posted that "ETH has ended a week-long bear market, and we are expected to meet a new round of rise with the unanimous interest rate cut we expected."

Although Arthur Hayes once believed that there would be no signal of a rate cut before Powell's speech, he still said in an interview, "As long as ETH breaks through the all-time high, the upside will be fully opened, and the price will reach $10,000 – $20,000." ”

On-chain whales swap ETH

After Powell's speech, as the price of ETH broke through a new high, a Bitcoin OG deposited 300 BTC to Hyperliquid to exchange ETH, and it has already made a floating profit of more than $160 million, now holding 118,277 ETH and 135,265 ETH in long positions.

At the same time, the much-watched "$125,000 rollover long ETH" whale bet on interest rate cuts to long ETH before Powell's speech, and as the night rally increased, he increased his position through floating profit rollover, and his ETH position increased from 4,000 at the opening of the position on the morning of August 22 to 25,100, with a position value of $120 million and a floating profit of $5.5 million, and the current liquidation price of the position is $4,666.

Huang Licheng, the big brother of Maji, who owns "infinite bullets", has also closed his long positions in BTC, HYPE, PUMP, YZY and other positions at a loss. Only ETH 25 times leveraged long positions were left, with a floating profit of more than $3 million and a total profit of about $37 million, which shows that it is still optimistic about the future of ETH.

But the market is also overheated at the moment, and traders should also be sane. A FOMO trader sold 2,277 ETH (worth $9.57 million) at $4,203 5 days ago, and bought 1,966 ETH (worth $957 million) at $4,869 about 6 hours ago because FOMO was chasing the up. Currently, it has lost about 311 ETH (worth $1.5 million).

Although Powell sent a positive signal about the interest rate cut this time, the actual implementation is still unknown. Fed Hammack cautiously said after Powell's speech, "I heard that Fed Chairman Powell is 'open' to the policy outlook, but the Fed should stick to a moderately tight monetary policy." The Fed's Musalem also added this morning, "Whether to cut interest rates should look at the entire interest rate path, not just the interest rate decision at a certain meeting." Inflation is already above target and there are ongoing risks. The next jobs report may be enough to justify the need for a rate cut, or it may not be enough, depending on what the report is about. ”

It remains to be seen how the crypto market and ETH market perform.