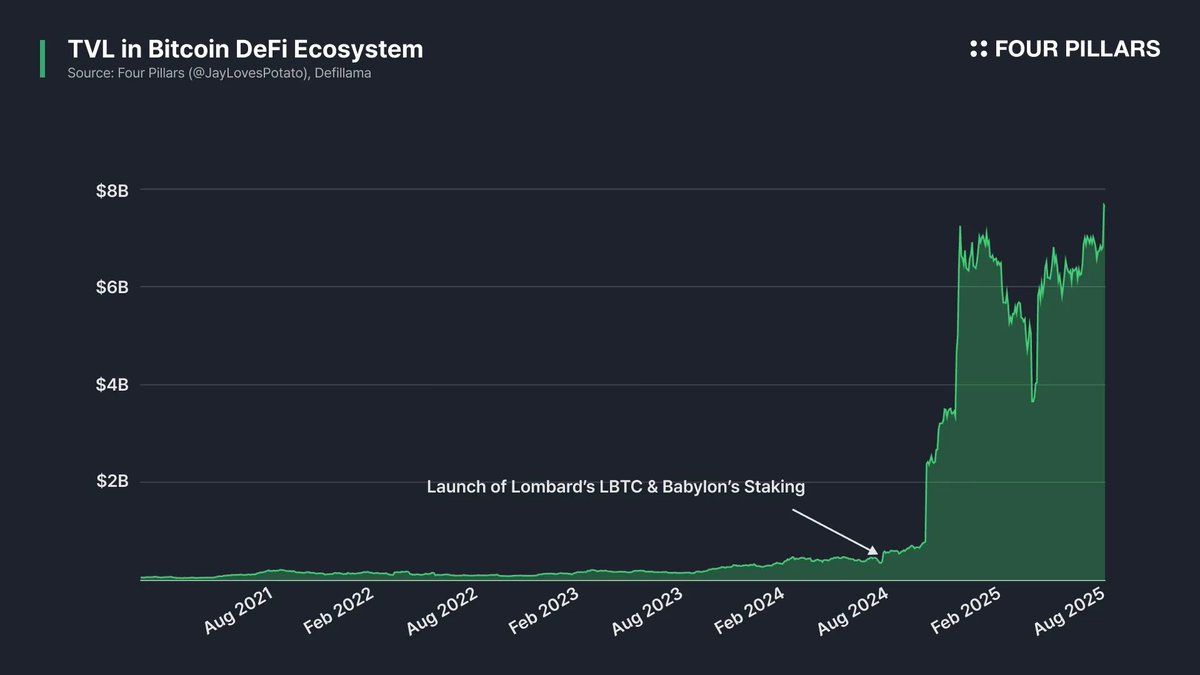

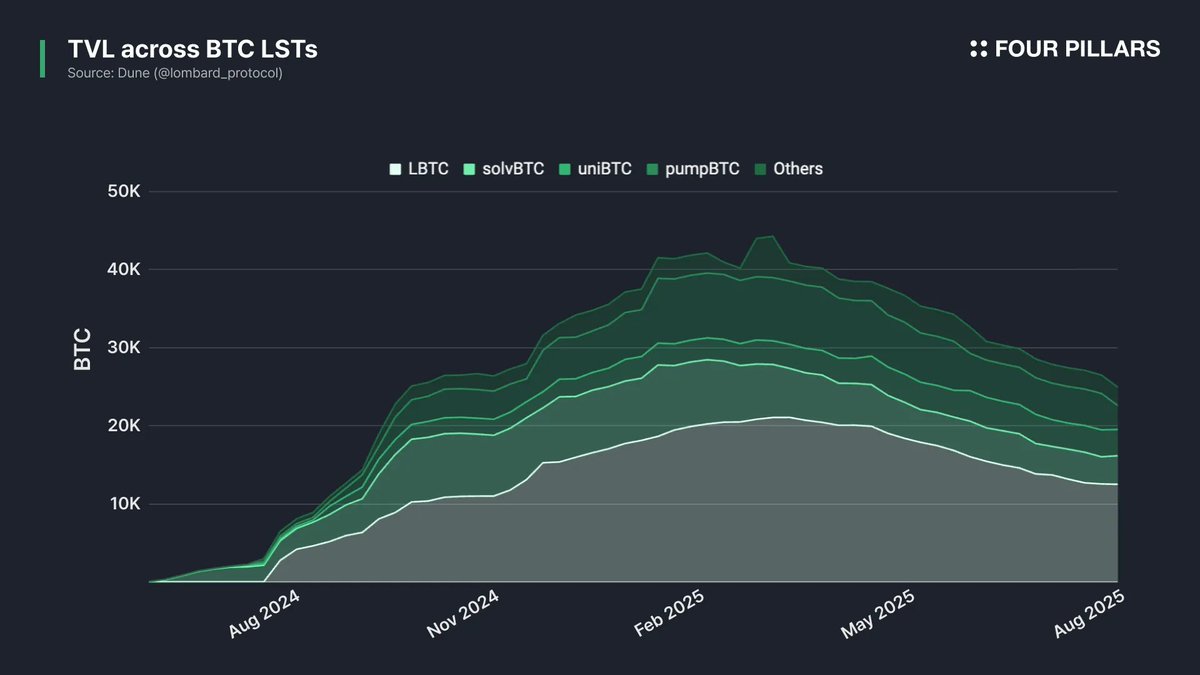

: : Who Is Most Likely to Activate the Onchain Bitcoin Market? Valuable crypto assets have the power to form economies of their own - the native tokens of leading smart contract platforms did so, the tokens of major DeFi protocols did so, and more recently, stablecoins have as well. Now, we are beginning to see that same potential with Bitcoin. @Lombard_Finance is emerging as one of the key players driving this vision. While a year may feel like a short span in the rapidly shifting crypto market, @Lombard_Finance has already achieved remarkable progress in that time. With its first product, LBTC, @Lombard_Finance proved that $BTC can function as a yield-generating asset and circulate across a wide range of platforms. Today, LBTC commands an outstanding 57%+ share of BTC LSTs, achieves over 80% utilization in DeFi, and has surpassed $2 billion in TVL. Yet simply minting and distributing an LST is not enough to transcend the existing DeFi landscape. That's why @Lombard_Finance 's...

12.98K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.