Written by: 0xResearcher

If the market is a thermometer of emotions, then "treasury allocation" is the voting device of enterprises. Who puts real money on the balance sheet and bets on which altcoins are often more reliable than the buzz of social media. In 2025, we will see more and more listed companies incorporating non-BTC and non-ETH tokens into their treasuries in public disclosures, such as FET and TAO in the AI track, HYPE and ENA in the new DeFi infrastructure, as well as payment veterans LTC and TRX, and even DOGE with a stronger community color. Behind these positions, there are both business synergies and asset diversification demands, which give ordinary investors a window to "see the direction of the wind": who buys, why they buy, and how to use them after buying. From these questions, it will be easier for you to distinguish between strong and weak narratives, and understand which copycats are being taken seriously by "institutionalized funds".

Why look at the treasury allocation?

Use "real money for the enterprise" to identify strong narratives. First, because it is more difficult to fake. Once a company writes tokens into financial reports or regulatory documents, it means that management has to explain the size of the position, accounting policies, custody and risks, which is more binding than "shouting slogans". Second, it is closer to "using and holding". In this treasury wave, many companies not only buy tokens, but also sign technical cooperation, introduce tokens as products or do on-chain staking income, such as Interactive Strength plans to purchase about $55 million in FET and cooperate with fetch.ai signs, Freight Technologies binds FET to logistics optimization scenarios, and Hyperion DeFi uses HYPE for staking and collaborates with Kinetiq Opening up the yield and collateral path, TLGY (proposed to be merged into StablecoinX) plans to establish an ENA treasury betting on Ethena's synthetic stability and yield structure. What these actions have in common is that tokens are not only prices, but also "certificates" and "fuel". Third, it provides an alternative path for ordinary investors. You can research tokens directly or gain "indirect exposure" by researching publicly traded companies that hold them. Of course, this is a double-edged sword: small market capitalization companies superimpose high-volatility tokens, and their stock prices often become "token agents", and the rise and fall will be more violent. If you take the path of "indirect exposure to stocks", position control and rhythm are particularly important.

This trend is accelerating from the market context of 2025. On a macro level, the landing of spot crypto ETFs in the United States has increased risk appetite, and the strength of BTC and ETH has given altcoins a "point-to-surface" spillover window, and high-quality tracks have gained more attention. The attitude of the company is also changing: from "tentative holding" a few years ago to "strategic allocation", and even a new species of "crypto treasury as the main business" has emerged - some companies have taken the initiative to transform and clearly regard the construction and operation of crypto treasury as the main line business. At the disclosure level, companies are no longer satisfied with press releases, but more through regulatory documents, quarterly reports, and investor presentations to disclose position size, fair value, custody details, and risk control arrangements, and the verifiability of information is increasing. In short, the heat is back, the path is clearer, and the funds are starting to be more "serious". This also means that observing treasury dynamics is becoming a reliable window into the direction of the industry.

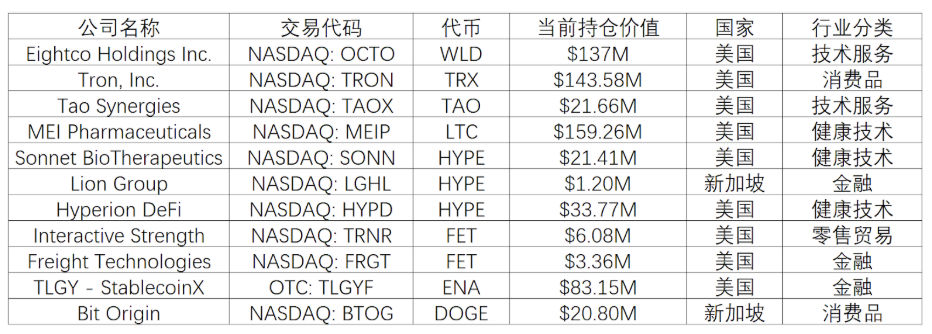

Statistics on recent altcoin holdings of listed companies

Three main lines of altcoins: AI, new DeFi and payment old coins

AI track (FET, TAO): The key signal of this main line is "use and hold". Tokens in AI-native networks are often not simply speculative targets, but "tickets and fuel" for access and settlement: the call of intelligent agents, access to computing power and model markets, and network incentives all require endogenous use of tokens. The entry of enterprise treasury is often accompanied by technical cooperation and business integration, such as the formation of a closed loop in logistics optimization, computing power call or intelligent agent landing, so the speculative weight is relatively low and more strategic allocation. However, there are also uncertainties in this track: the combination of AI and blockchain is still in the verification stage, valuations may reflect future expectations in advance, and the long-term sustainability of the token economy (inflation/deflation mechanism, incentive model, fee recovery) still needs to be observed.

New DeFi infrastructure (HYPE, ENA): This track is a combination of "efficiency + income". HYPE represents a performance-oriented DeFi infrastructure: it carries derivatives trading and staking derivatives through a high-performance chain, forming a capital cycle of "earning income + liquid staking and re-staking", providing an efficient utilization path for institutions and capital pools. The interest of corporate treasury is that it can not only bring on-chain governance and income, but also enhance liquidity and market stickiness through capital circulation.

ENA's appeal is more focused on the design of synthetic stability and hedging returns. By combining staking derivatives and hedging strategies, Ethena attempts to create "dollar-like" stable assets and generate endogenous sources of income without relying on the traditional banking system. If this model can be connected with exchanges, custodians and payment sides, it may form a truly closed-loop "crypto dollar + yield" system. For corporate treasuries, this means holding a stable unit of account while also providing income and tools to hedge against volatility. However, the risks are also more complex: clearing security, robustness of smart contracts, and stability in extreme market conditions are all key points that require high-intensity audits and risk control.

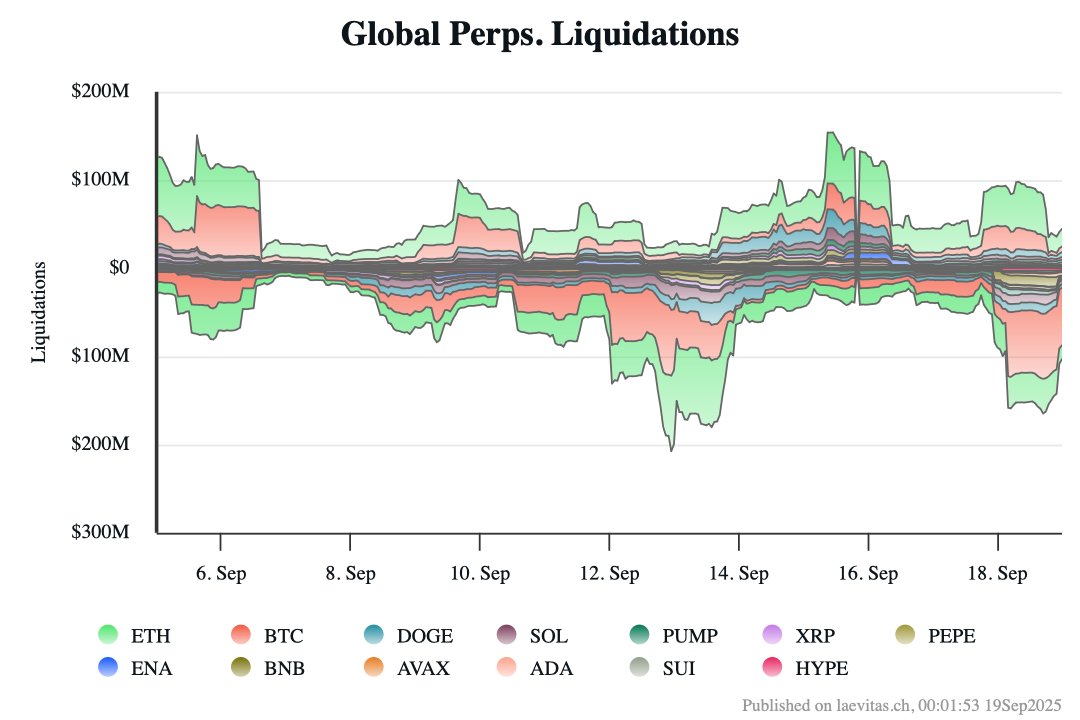

Source: X

Payment and established market (LTC, TRX, DOGE): In contrast, this group of assets is more inclined to "worry-free bottom positions and payment channels". They have a longer history, stronger liquidity, and better infrastructure, so they are convenient to become a "cash-like" allocation for corporate treasuries, which can meet both long-term stores of value and payment scenarios. The efficiency advantages of LTC and TRX at the payment and settlement layers make them direct payment exposure for treasuries; DOGE, on the other hand, has unique value in light payments and topic communication with its community and brand spillover effects. Overall, the role of such assets is more robust and fundamental, but new growth stories are limited, and the future may be more under competitive pressure from stablecoins and L2 payment networks.

Know what to buy, but also know how to look at it

See the direction of the wind, but don't make simple analogies. Which token a company writes into its financial report is equivalent to voting with real money, which can help us filter out a lot of noise, but it is not a universal indicator. A more comprehensive observation framework looks at three levels at the same time: whether there is business collaboration (does the company really use this token), whether there is formal disclosure (written into regulatory documents, explaining how much was bought, how to keep it, and what are the risks), and whether the on-chain data can keep up (activity, transaction depth, and whether liquidation is stable). The true value of corporate treasury allocation lies not in providing investment advice, but in revealing the underlying logic of industry evolution - when traditional listed companies begin to allocate specific tokens on a large scale, this reflects the structural transformation of the entire crypto ecosystem from "pure speculation" to "value anchoring".

From a macro perspective, this wave of treasury allocation marks the intersection of three important trends: the maturity of the regulatory environment - companies dare to disclose their crypto asset holdings in public documents, indicating that a compliance framework is being established; The materialization of application scenarios - no longer an abstract "blockchain revolution" but quantifiable business needs such as AI training, DeFi income, and cross-border payments. Institutionalization of capital structures – from retail led to corporate participation – means longer holding cycles and more rational pricing mechanisms. The deeper significance is that treasury allocation is redefining the essence of "digital assets". In the past, we used to think of cryptocurrencies as high-risk speculative tools, but as more and more companies use them as operational assets or strategic reserves, they begin to have attributes similar to foreign exchange reserves, commodity inventories, or technology licenses. This shift in perception may be more disruptive than any technological breakthrough.