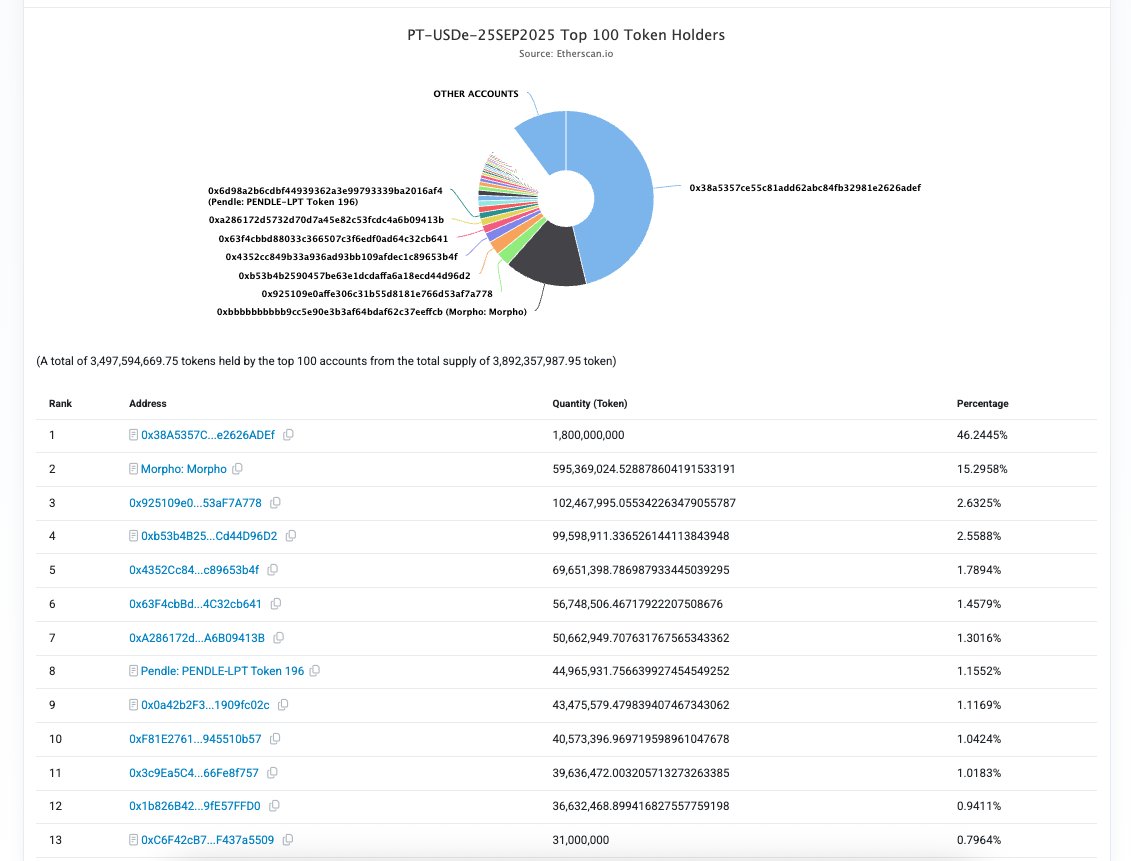

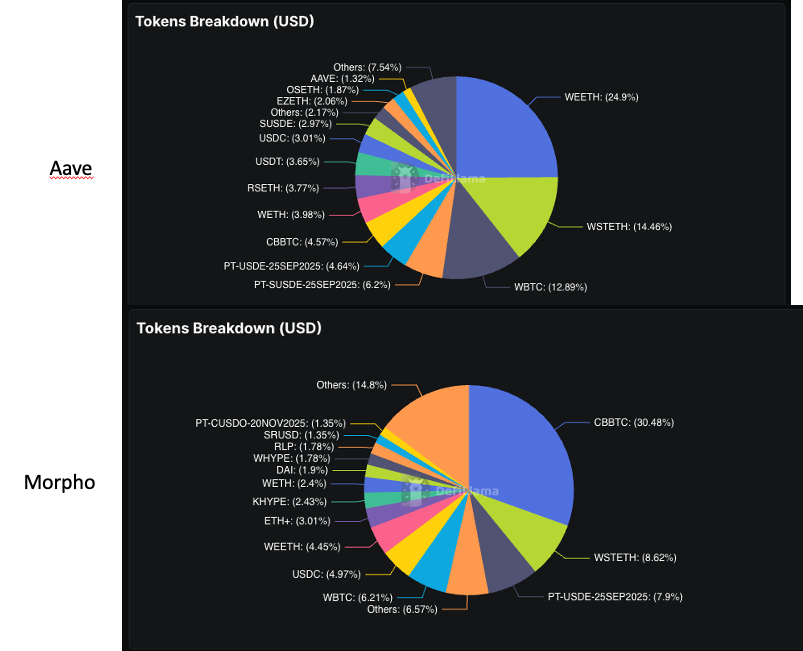

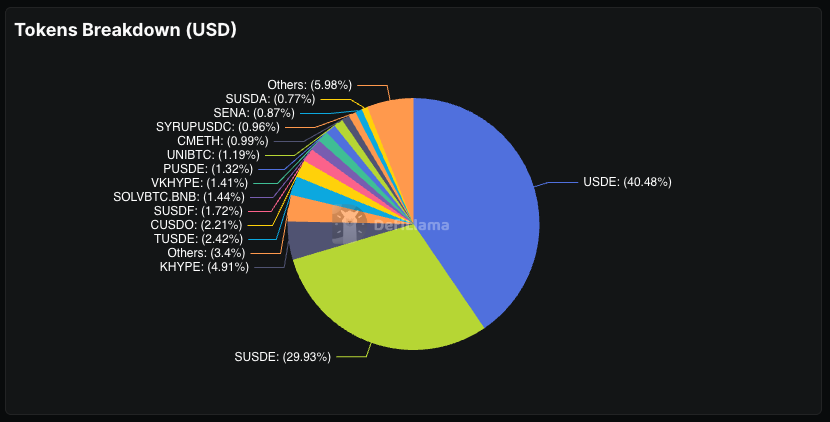

You know what's funny about the whole Pendle "network effect" narrative? Everyone talks about it like it's a social app where more users make it better for everyone else. It's not. The core mechanics work against that. 1) Every new asset is its own isolated island. 2) USDe liquidity doesn't help the sKaito guy. 3) A June expiry pool is useless to the September guy. It's network effects in reverse (more fragmentation) So if the retail user base isn't the real moat, what is? Look at the on-chain data. Who actually holds the PTs? It's not a million retail farmers. It's protocols. Big ones. Look at the PT-USDe pool. Something like 60% of it is held by a handful of wallets belonging to Morpho and Aave. They aren't just parking cash there; they're running complex, multi-step looping strategies that are an absolute pain to unwind. The real moat isn't user count. It's operational friction. Pendle has become the backend plumbing for other protocols' yield strategies. They've...

I think there are some parts to understand Pendle’s moat that’s missing. Here’s how I see its real competitive advantage. The core challenge is that Pendle's structure naturally isolates its markets and user activity. This limits the kind of compounding network effect seen in other platforms. 🟢 Asset Isolation: Each token creates its own distinct network. For example, users interested in USDe don’t really interact with or benefit those interested in sKaito, as their goals and liquidity pools are separate. 🟢 Expiry Date Silos: Liquidity is further divided by maturity dates. A USDe token expiring in one month exists in a completely different market from one expiring in several months. While I understand there are easy ways to migrate positions at expiry, but this is a UX thing because the same dollar cannot be used in both maturities. 🟢 Rivalry by Design: Economic rivalry exists via pricing: as PT price rises, implied/fixed APY falls for later buyers, so earlier purchases can...

3.63K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.