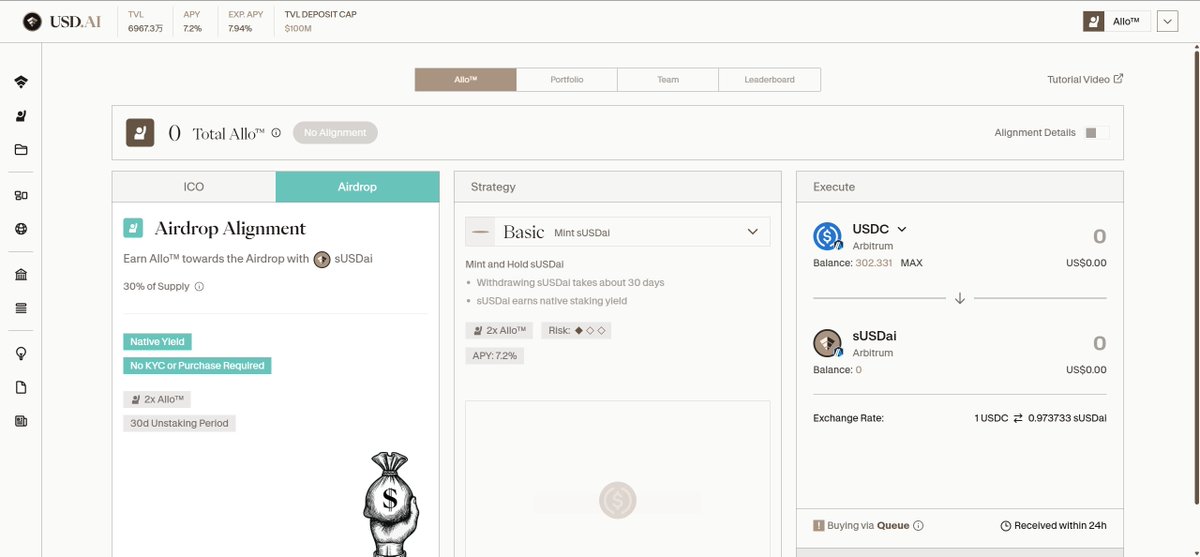

Current deposit projects, especially for stablecoin deposits

Portal:

Everyone should go deposit some low insurance, right? 😂

This time it's USDC on the Arbitrum chain.

There's no cost or loss involved.

I recommend choosing the Airdrop mode.

There's really no risk to bear.

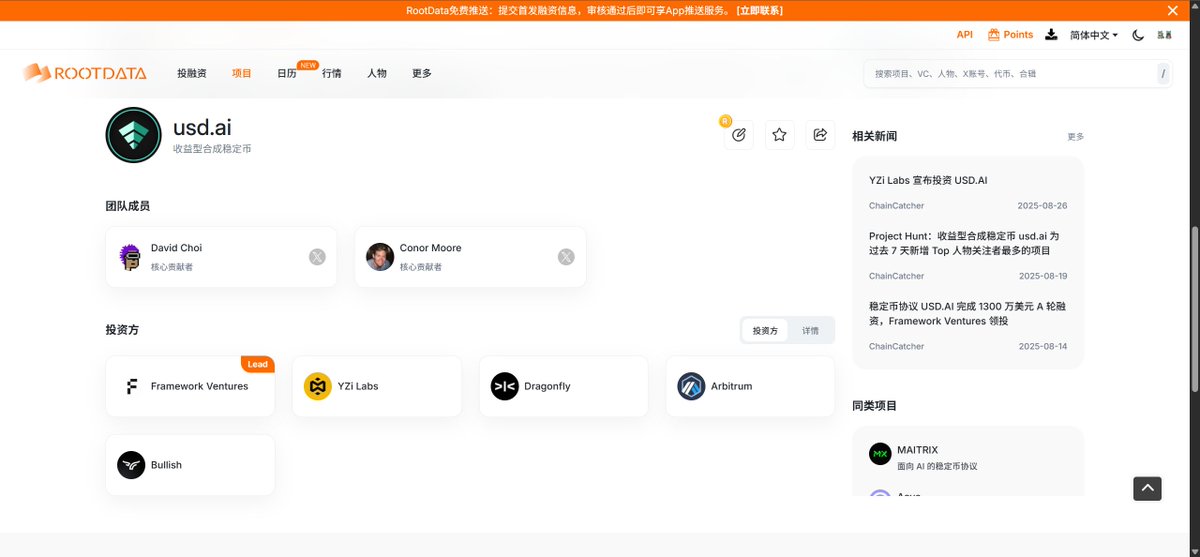

Just announced @yzilabs investment.

A few days ago, there was also a $13 million Series A round,

led by Framework Ventures.

Those doing stablecoin projects are all strong players,

like @FalconStable, which is invested by the Trump family project.

In a bull market, I suggest everyone build positions and swap for stablecoins.

Deposit the stablecoins to earn some interest and airdrops.

When the bear market comes, withdraw to buy the dip on Bitcoin and Ethereum.

USDai is a yield-bearing synthetic stablecoin, supported by computing resources, AI hardware, and network nodes. It funds decentralized infrastructure assets like GPUs and mobile signal towers to address liquidity gaps. The platform trades using the $USDAI token, providing yield through asset-backed stability.

@USDai_Official

The Almanak deposit of 100u for the low guarantee is also possible 👇

Portal:

Analysis:

I have analyzed several key points for everyone, with no cost, no risk, potentially high returns, and quick recovery of benefits. The project will soon issue tokens for airdrop.

The current GAS is only 0.15 😥

Can you spend a few cents on GAS?

It's still better to deposit stablecoins.

If it's correct, you can take advantage of it.

If it's a project that will issue tokens very late,

then it's really not necessary.

This thing doesn't issue tokens immediately.

Almanak is a platform that automatically builds and optimizes DeFi strategies using AI, completely code-free, suitable for users who don't understand technology but want to participate in complex strategies.

- AI automatically optimizes strategies for practical markets.

- The platform uses modular AI agents (MSA).

- The free combination of strategies ensures high flexibility.

After the first vault went live, the 5 million limit was snatched up within 24 hours, and it was quickly raised to 15 million, which also filled up fast. Currently, there is a stablecoin pool with an APY of about 40% (8.75% base yield + 31% project token rewards) that we are depositing into.

The platform will simulate various extreme situations to ensure that the strategy can withstand market fluctuations and guarantee the safety of funds in the future, starting with a "stress test."

A few days ago, Almanak secured an investment of 8 million dollars from Legion (with a valuation of 45 million dollars) and is expected to release an airdrop in September.

The $alUSD pool is running, and those who want to participate can deposit a low guarantee of 100u.

Follow @Almanak__

16.15K

11

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.