Previously, we discussed that the price difference between $ZRO and $STG is essentially a measure of the market's confidence in whether LayerZero can successfully acquire Stargate. However, the plot has thickened in the past couple of days, as Wormhole has jumped in, turning this from a mere acquisition into a full-blown bidding war. So let's continue with our previous line of thought and pull out the timeline to review how the market has been pricing this step by step.

➤ Phase One: LayerZero's Offer

LayerZero's terms are 1 $STG = 0.08634 $ZRO.

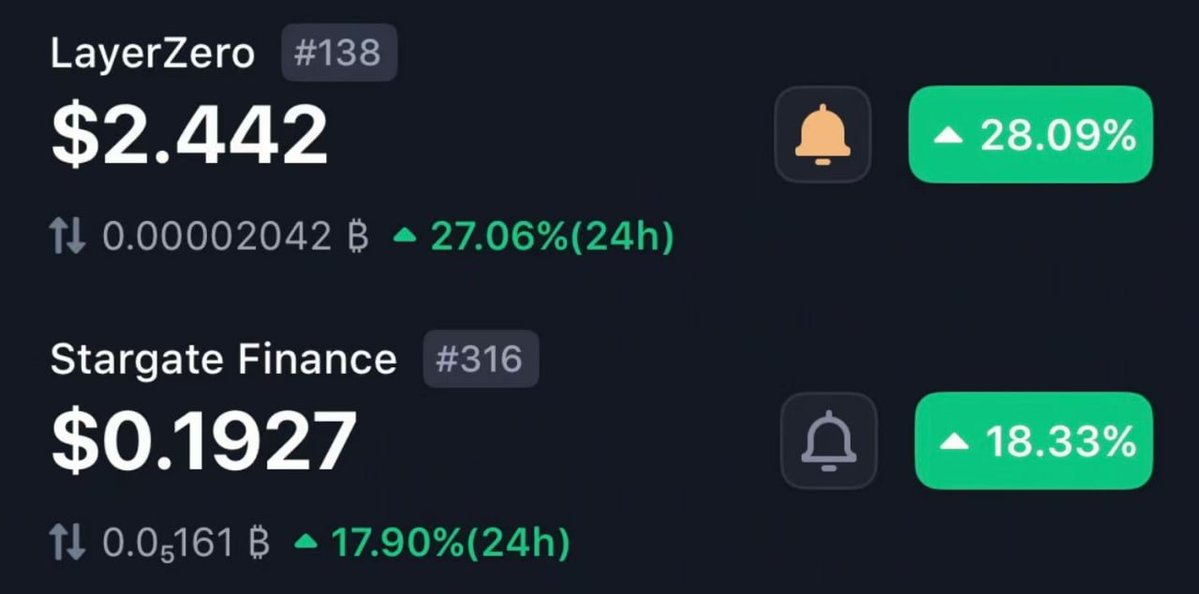

At that time, $ZRO was around $2.44, which implies an intrinsic price for $STG of $0.21.

In the actual market, $STG was around $0.19, indicating an 8.5% discount.

👉 The signal is clear: everyone thinks the deal is likely to go through, but there's still some risk buffer.

➤ Phase Two: Convergence of Price Difference

Later, $ZRO dropped to $2.25, which changed the implied price of $STG to $0.194, while $STG itself also fell to $0.18, narrowing the gap to 7.4%.

👉 This step is quite intuitive: the smaller the price difference, the more the market believes this can be resolved.

➤ Phase Three: Wormhole Suddenly Enters the Scene

Just as the market was beginning to accept LayerZero's logic, Wormhole suddenly announced:

① They believe LayerZero's offer undervalues Stargate;

② They provided data support—$4 billion in bridging volume in July, a tenfold year-on-year increase, with a $TVL of $345 million, and an expected annual revenue of $2 million;

③ They also demanded a pause in voting to submit a higher bid themselves.

👉 At this point, the anchor set by LayerZero was directly broken, and the market began to calculate another equation: is there a possibility of even higher bids?

➤ The pattern is quite clear:

1) Initially, the price difference serves as a barometer;

2) However, once bidding begins, the price difference becomes irrelevant, and the core question shifts to who is willing to offer a higher price.

In other words, this is no longer a simple arbitrage game, but a standard merger auction logic.

🔹 My own perspective:

1) In the short term, the volatility range of $STG will be much larger than before, with the focus of arbitrage shifting from monitoring price differences to monitoring premiums. Early movers may directly push up the price.

2) In the medium to long term, Stargate itself is cross-chain infrastructure with solid data growth, so buyers will not be lacking. Even if LayerZero fails to acquire, Wormhole's involvement effectively provides a floor for token holders.

So now, the play with $STG has changed:

👉 Either bet on short-term premiums,

👉 Or wait for the merger to finalize and see how long-term value is reassessed.

刚看到 LayerZero 想收购 Stargate 的消息,报价是 1 $STG 换 0.08634 $ZRO。根据昨天和今天的 $ZRO 价格,我们用价格差距来判断市场对这笔收购的信心,挺有意思的。

昨天 $ZRO 价格约 2.44 美元,换算出 $STG 隐含价大概是 0.21 美元,而实际 $STG 价约 0.19 美元,价差约 8.5%。这个差距反映了市场对收购顺利通过仍有一定疑虑,但整体信心还算不错。

到了今天, $ZRO 掉到了 2.25 美元,对应的 $STG 隐含价降到了约 0.1943 美元,实际 $STG 价格跌到 0.18 美元,价差缩小到了 7.4%。价差变小意味着市场对这次收购的认可度提高了,投资者更倾向于相信提案会顺利过关。

这价差其实是一个挺好的风向标:差距大,市场担心风险高;差距小,说明交易更有可能成功。7.4% 和 8.5% 的价差都不算大,说明多数人认为这笔收购最终会按现在的条款推进。

当然,风险依然存在,比如投票结果不确定,ZRO 价格波动等,都可能影响最终走向。短期看,这类消息带来的情绪波动大,炒作空间不小,但最终还是要盯着投票和市场实际反馈。

总结一下:价格差距从 8.5% 缩小到 7.4%,透露出市场对 LayerZero 收购 Stargate 的信心在逐步增强,大家可以把它当成参考指标,结合投票动态和行情,灵活调整自己的策略。

图例左边是昨天的,右边是今天的

10.92K

29

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.