Lido Staked Ether price

in USDTop market cap

$4,214.33

+$30.6 (+0.73%)

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

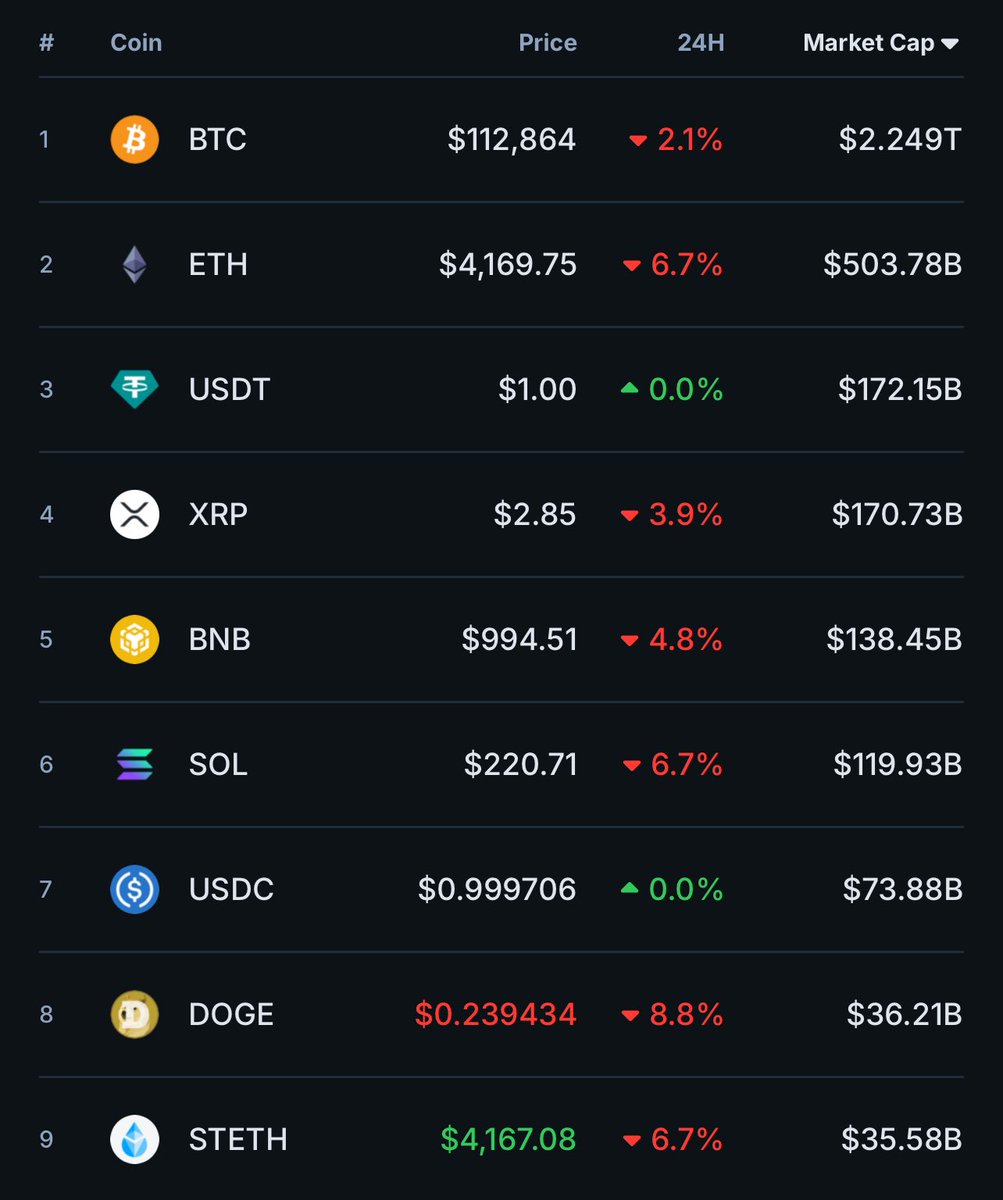

Market cap

$35.94B #8

Circulating supply

8.54M / 8.54M

All-time high

$4,943.6

24h volume

$47.39M

3.6 / 5

About Lido Staked Ether

STETH (Lido Staked Ether) is a token that represents staked Ethereum (ETH) through the Lido platform. When you stake ETH with Lido, you receive STETH in return, which accrues staking rewards automatically over time. This allows users to earn passive income while maintaining liquidity, as STETH can be traded or used in decentralized finance (DeFi) applications. Lido simplifies the staking process by pooling ETH from many users and managing the technical aspects of running validators. STETH is widely used in DeFi for lending, borrowing, and liquidity provision, making it a versatile asset for both earning rewards and participating in the broader crypto ecosystem.

AI-generated

Lido Staked Ether’s price performance

Past year

+57.65%

$2.67K

3 months

+75.25%

$2.40K

30 days

-11.93%

$4.78K

7 days

-5.54%

$4.46K

Lido Staked Ether on socials

Fantastic explainer on the mechanics of mXRP and its implications for XRP and XRPL. Love to see builders coming together to educate the community on an important topic!

Panos 🔼{X}🇬🇷

There are many questions around $mXRP and I have gathered the 10 most common ones and created a FAQ:

1. What is mXRP?

mXRP is the first liquid staking token on XRPL. It's a yield-bearing version of XRP that generates yield for its holders. So the price of mXRP should continuously grow against XRP and trade at a premium. In simple words: mXRP = XRP + accumulated yield.

2. Where can I buy it?

You have 2 options:

1. You can either go directly to the issuer's platform ( to mint mXRP, but it has limitations on jurisdictions and it's a bit complicated since you must bridge and use multiple wallets.

2. Or... you can simply use to access it directly from XRPL and swap from XRP to mXRP without any complications.

3. Where does the yield come from?

From various strategies including lending, market making, depositing on DeFi protocols etc. The asset managers first lock XRP and borrow against it in stablecoins, and then they use the stablecoin capital for different strategies to make money. The whole process is transparent and it will be accessible here:

4. How do I claim the yield or redeem for XRP?

All you need is to hold mXRP. Something to clarify is that you don't receive extra tokens, the yield and rewards are automatically added and embedded into mXRP's value. So the way it works is that in 1 year from now selling 100 mXRP should get you 110 XRP, if the 10% APY is maintained (the APY and yield will be updated on weekly basis). So the profit is realized once swapped back to XRP or redeemed via As more and more yield is generated, mXRP's price should continuously grow against XRP, making it more and more expensive, and giving you more and more XRP over time when you swap back.

There is also the option to provide liquidity on the XRP/mXRP pool for extra yield generated by the LP fees:

5. Is it risk-free? How safe is it?

Nothing in life is risk-free, and $mXRP is no exception. Everything involves risk, either high or low. There’s always a chance of smart contract bugs, platform issues, or market swings messing things up. But, this is launched by industry leaders such as @axelar and @MidasRWA, which are also audited and regulated. You should always do your own research and decide for yourself if it's worth the risk for you or not.

6. Do I have to give up my XRP?

mXRP works in a similar way to other liquid staking tokens such as stETH, jitoSOl, sAVAX. Which means that if you want to get the yield from these tokens, you have to buy that asset and hold it. Either that's by selling XRP or adding new capital to buy mXRP.

7. Is this good for XRP? Will add buying or selling pressure?

As mentioned by Axelar and Midas, the goal is to become a perpetual buyer of XRP. Every XRP used to mint mXRP is locked, meaning it's taken out of circulation. And with the extra yield generated, more XRP is bought, adding constant buying pressure.

8. What's the role of @AnodosFinance on this?

Anodos is one of the main partners of Axelar and the go-to DEX interface for the XRPL ecosystem, giving easy access to mXRP via swaps and liquidity pools. Axelar's bridge is used to move mXRP from the XRPL EVM sidechain to XRPL, bringing mXRP directly to XRPL mainnet, and through Anodos' ANODEX users can easily access it without going through the complicated procedure from the EVM sidechain.

9. What's the difference between mXRP and FXRP?

mXRP and FXRP are a bit different, but ultimately both good for XRP and XRPL. mXRP is a yield-bearing token that is available directly on XRPL, and backed 1:1 by XRP. It has some centralized elements and the capital is managed by asset managers, but easily accessible. FXRP, on the other hand, is a trustless version of XRP on Flare Network (backed and overcollateralized by FLR, stablecoins, and XRP), but it doesn’t inherently generate yield like mXRP. FXRP is for using it primarily on Flare network and deploying it by yourself into different DeFi protocols and strategies to generate yield, while mXRP is not trustless, but does all the heavy lifting for you and all you need is to just buy and hold.

10. Should I jump in with all my XRP?

As with any asset, never put everything in one basket. First understand how it works, what are the risks, and what amounts you feel comfortable with investing and holding.

You can also listen to some key points from Axelar and Midas founders @yorgosv_ and @DDinkelmeyer!

And also the space and Q&A we did with Yorgos:

If you have any other questions, shoot them in the comments.

There are many questions around $mXRP and I have gathered the 10 most common ones and created a FAQ:

1. What is mXRP?

mXRP is the first liquid staking token on XRPL. It's a yield-bearing version of XRP that generates yield for its holders. So the price of mXRP should continuously grow against XRP and trade at a premium. In simple words: mXRP = XRP + accumulated yield.

2. Where can I buy it?

You have 2 options:

1. You can either go directly to the issuer's platform ( to mint mXRP, but it has limitations on jurisdictions and it's a bit complicated since you must bridge and use multiple wallets.

2. Or... you can simply use to access it directly from XRPL and swap from XRP to mXRP without any complications.

3. Where does the yield come from?

From various strategies including lending, market making, depositing on DeFi protocols etc. The asset managers first lock XRP and borrow against it in stablecoins, and then they use the stablecoin capital for different strategies to make money. The whole process is transparent and it will be accessible here:

4. How do I claim the yield or redeem for XRP?

All you need is to hold mXRP. Something to clarify is that you don't receive extra tokens, the yield and rewards are automatically added and embedded into mXRP's value. So the way it works is that in 1 year from now selling 100 mXRP should get you 110 XRP, if the 10% APY is maintained (the APY and yield will be updated on weekly basis). So the profit is realized once swapped back to XRP or redeemed via As more and more yield is generated, mXRP's price should continuously grow against XRP, making it more and more expensive, and giving you more and more XRP over time when you swap back.

There is also the option to provide liquidity on the XRP/mXRP pool for extra yield generated by the LP fees:

5. Is it risk-free? How safe is it?

Nothing in life is risk-free, and $mXRP is no exception. Everything involves risk, either high or low. There’s always a chance of smart contract bugs, platform issues, or market swings messing things up. But, this is launched by industry leaders such as @axelar and @MidasRWA, which are also audited and regulated. You should always do your own research and decide for yourself if it's worth the risk for you or not.

6. Do I have to give up my XRP?

mXRP works in a similar way to other liquid staking tokens such as stETH, jitoSOl, sAVAX. Which means that if you want to get the yield from these tokens, you have to buy that asset and hold it. Either that's by selling XRP or adding new capital to buy mXRP.

7. Is this good for XRP? Will add buying or selling pressure?

As mentioned by Axelar and Midas, the goal is to become a perpetual buyer of XRP. Every XRP used to mint mXRP is locked, meaning it's taken out of circulation. And with the extra yield generated, more XRP is bought, adding constant buying pressure.

8. What's the role of @AnodosFinance on this?

Anodos is one of the main partners of Axelar and the go-to DEX interface for the XRPL ecosystem, giving easy access to mXRP via swaps and liquidity pools. Axelar's bridge is used to move mXRP from the XRPL EVM sidechain to XRPL, bringing mXRP directly to XRPL mainnet, and through Anodos' ANODEX users can easily access it without going through the complicated procedure from the EVM sidechain.

9. What's the difference between mXRP and FXRP?

mXRP and FXRP are a bit different, but ultimately both good for XRP and XRPL. mXRP is a yield-bearing token that is available directly on XRPL, and backed 1:1 by XRP. It has some centralized elements and the capital is managed by asset managers, but easily accessible. FXRP, on the other hand, is a trustless version of XRP on Flare Network (backed and overcollateralized by FLR, stablecoins, and XRP), but it doesn’t inherently generate yield like mXRP. FXRP is for using it primarily on Flare network and deploying it by yourself into different DeFi protocols and strategies to generate yield, while mXRP is not trustless, but does all the heavy lifting for you and all you need is to just buy and hold.

10. Should I jump in with all my XRP?

As with any asset, never put everything in one basket. First understand how it works, what are the risks, and what amounts you feel comfortable with investing and holding.

You can also listen to some key points from Axelar and Midas founders @yorgosv_ and @DDinkelmeyer!

And also the space and Q&A we did with Yorgos:

If you have any other questions, shoot them in the comments.

Guides

Find out how to buy Lido Staked Ether

Getting started with crypto can feel overwhelming, but learning where and how to buy crypto is simpler than you might think.

Predict Lido Staked Ether’s prices

How much will Lido Staked Ether be worth over the next few years? Check out the community's thoughts and make your predictions.

View Lido Staked Ether’s price history

Track your Lido Staked Ether’s price history to monitor your holdings’ performance over time. You can easily view the open and close values, highs, lows, and trading volume using the table below.

Own Lido Staked Ether in 3 steps

Create a free OKX account

Fund your account

Choose your crypto

Lido Staked Ether FAQ

Currently, one Lido Staked Ether is worth $4,214.33. For answers and insight into Lido Staked Ether's price action, you're in the right place. Explore the latest Lido Staked Ether charts and trade responsibly with OKX.

Cryptocurrencies, such as Lido Staked Ether, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Lido Staked Ether have been created as well.

Check out our Lido Staked Ether price prediction page to forecast future prices and determine your price targets.

Dive deeper into Lido Staked Ether

stETH, an innovative transferable utility token, embodies a portion of the aggregate ETH staked within the protocol and comprises both user deposits and staking rewards. The token's daily rebasing feature ensures real-time reflection of its share's value each day, facilitating enhanced communication of its position.

ESG Disclosure

ESG (Environmental, Social, and Governance) regulations for crypto assets aim to address their environmental impact (e.g., energy-intensive mining), promote transparency, and ensure ethical governance practices to align the crypto industry with broader sustainability and societal goals. These regulations encourage compliance with standards that mitigate risks and foster trust in digital assets.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Market cap

$35.94B #8

Circulating supply

8.54M / 8.54M

All-time high

$4,943.6

24h volume

$47.39M

3.6 / 5