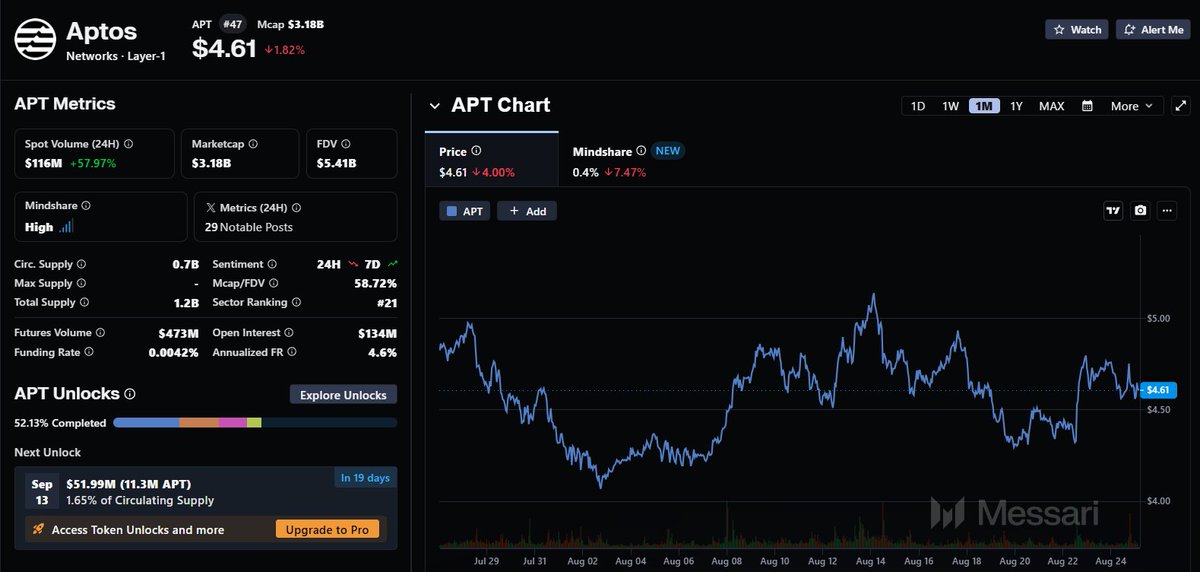

The $APT chart is at monthly Support! Is this a worthy L1 investment case for the upcoming wave? After analyzing the strengths of the $APT Ecosystem, I have a few bull cases: - The chart is at monthly Support, so the likelihood of a Pump > Dump, and part of it is that $APT holders have definitely cut losses already. - $APT has changed its CEO, so there will naturally be many new directions, and a price increase will be the only way to create a Narrative. - The Ecosystem has over 330 projects from DeFi, NFT to other Web3 applications, but lacks any narrative to pump. If $APT increases soon, it will act as a catalyst for the entire Ecosystem to rise as well. - There is already a flow of Stablecoin + TVL over $1B. Typically, Ecosystems like this, when pushed, can be extremely explosive. (The past wave from $3 to $20 has somewhat proven the strength of the project.) If it breaks below this price, it could drop -30%, but if it rises, I see a potential ROI of 50%-x2. Feel free...

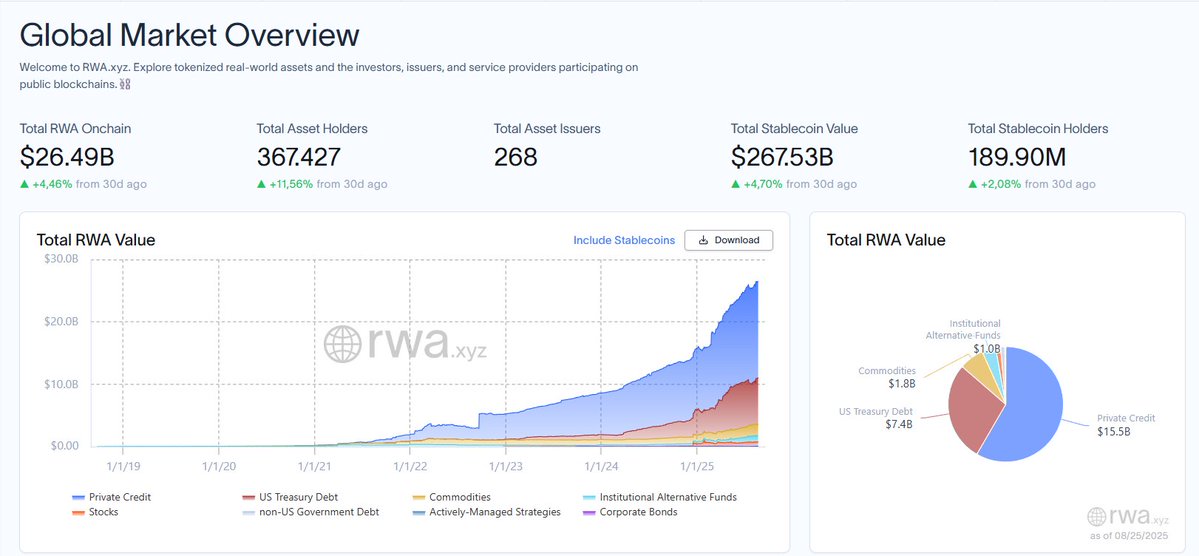

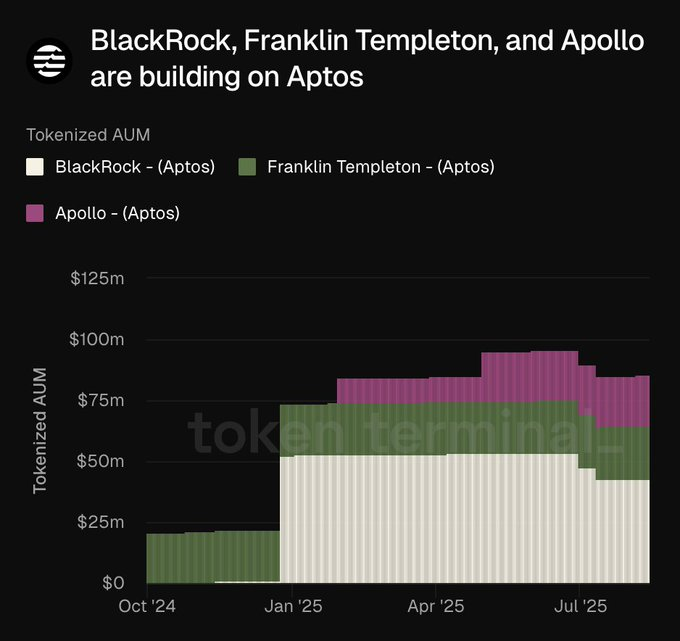

Is $APT an investment opportunity for the upcoming Bull Coin-Top wave? There must be many $APT holders here. I just checked the project data and saw that @Aptos is experiencing quite stable growth. Below is a detailed analysis with new insights, updated data, and reasons why you should research $APT: - Aptos is positioning itself as a "Global Trading Engine" with top-notch technical infrastructure, explosive adoption, and a promising DeFi stack. - With a market value of ~$3.2B. Compared to other L1s in the market, this market cap still has a lot of room to grow strongly to the 10B-20B-30B,... 1⃣ Technical Infrastructure: Fast, Cheap, Stable - Blocktime 0.11s, finality under 1s – the fastest among top L1s - Transaction fee ~$0.0001, cheaper than 90% of competitors according to Messari - Testnet throughput 160,000 TPS, uptime 99.99% (Dune Analytics). - Move-based, user-friendly dev tools, >500 dApps, 200% YoY growth (DefiLlama). - Aptos integrates ZK-proofs in the Q4/2024...

34.83K

173

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.