🏘️⛓️ RWA Weekly News: Policy, Liquidity & Markets Advance

Hong Kong launches an official RWA registry, tokenized stocks surge 220% with @xStocksFi reaching $2B/day, BTC flows toward RWA yield via @SolvProtocol’s BTC+ vault, and major firms eye equity tokenization.

Dive in 👇🧵

@MorphoLabs @zoniqxinc @plumenetwork @AzosFinance @MANTRA_Chain @pharos_network @galaxyhq 🔎 DIA xReal: The Oracle Layer for RWAs

From treasuries and real estate to FX and private credit, DIA delivers transparent, verifiable price data across 60+ chains, built for tokenization at scale.

Learn more ↓

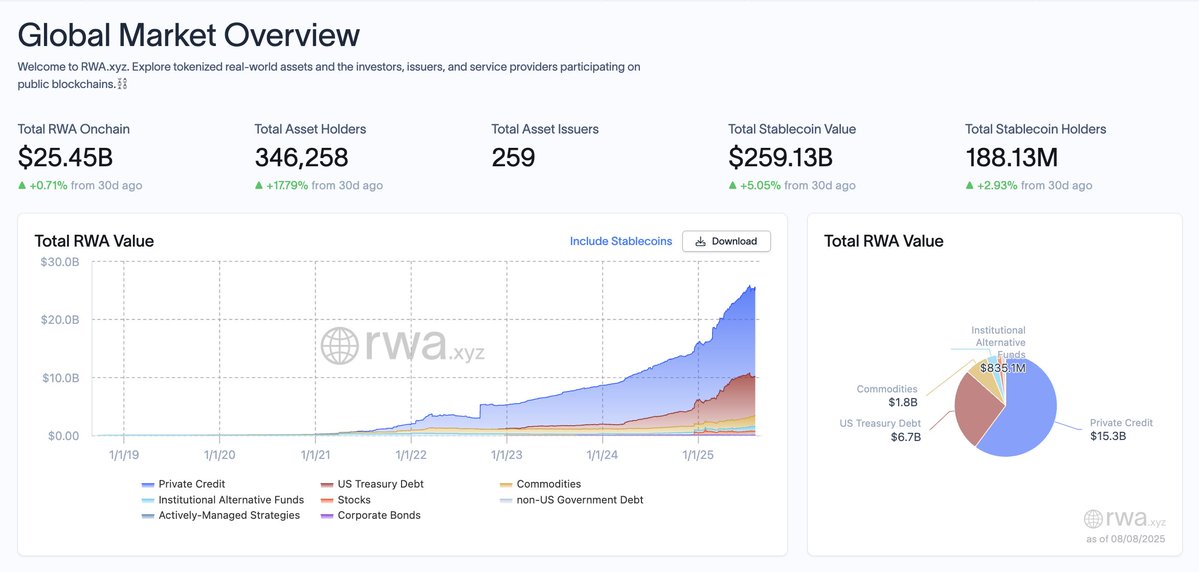

📊 RWAs in Numbers (August 8th)

• Total RWA On-chain: $25.45B

• Asset-backed stablecoin total market cap: $259.13B

• Total asset issuers: 259

• Leading RWA chains: Ethereum, ZKSync Era, Aptos, Solana, Stellar.

Learn more at

♻️ Azos Finance Integrates DIA Oracles to Power the Collateral Layer of Climate Impact Assets

@DIAdata_org's oracles will provide pricing data for @AzosFinance's collateral system, enabling a new class of tokenized impact assets to be used within DeFi on @base.

💸 Harbour Capital Invests $1.2M in Polkadot RWA Projects

Harbour Industrial Capital backs four high-growth RWA-focused teams building in the @Polkadot ecosystem.

📈 Tokenized Stocks Jump 220% in July, Echoing DeFi Boom

The surge in tokenized stock volume signals growing demand for real-world asset exposure in crypto.

🔶 Solv Protocol Eyes $1T in Idle BTC for RWA Vaults

@SolvProtocol launches BTC+ yield vault, aiming to channel dormant Bitcoin into institutional-grade RWA strategies.

📊 XStocks Hits $2B Daily Volume, Led by Tokenized Tesla

@xStocksFi sets new trading record, with tokenized $TSLA shares driving massive activity.

⛓️ Galaxy Digital Considers Tokenizing GLXY Shares

@galaxyhq explores turning its own equity into tokenized assets amid broader RWA finance experiments.

💰 MANTRA Raises $20M to Expand Global RWA Stack

Backed by @InveniamIO, @MANTRA_Chain will scale its tokenized real asset infrastructure from the UAE to the U.S.

🇭🇰 Hong Kong Launches Official RWA Registration Platform

A new gov-backed RWA registry launches in Hong Kong to support tokenization compliance and growth.

💥 Plume Launches Ascend Accelerator for RWA Startups

@plumenetwork's new accelerator aims to back early-stage teams building tokenized real-world asset infrastructure.

⛓️ Morpho Moves $9B Lending Protocol to Pharos L1 for RWA Finance

@MorphoLabs integrates with @pharos_network Layer 1 to bring its high-volume lending engine to tokenized real asset markets.

🏦 DL Holdings Raises $83M+ for RWAs and BTC Mining

DL secures HK$653M to fuel its dual push into tokenized real assets and Bitcoin mining expansion.

🌀 RWAs are scaling across policy, products, and rails:

• Gov support (HK registry)

• Equity & credit going on-chain (xStocks, Galaxy, Solv)

• Fresh capital & infra (MANTRA raise, new accelerators)

Tokenization is becoming core market infrastructure. Back next week with more.

20.72K

142

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.