Interpreting the crypto project buyback craze: Why don't currency prices buy it?

Original title: Do Token Buybacks Work?

Original author: RichKing | RPS AI

original compilation: TechFlow

In our conversations with developers, we found that simple guidelines on on-chain liquidity management are very rare for early teams. As liquidity providers (LPs) and on-chain market makers, we often see common mistakes that go unnoticed until they evolve into costly problems. And most centralized exchanges (CEXs) market makers don't seem to provide much guidance on how to manage on-chain liquidity.

– >

– >

Heavendex AMM (Automated Market Maker) has established a mechanism where all transaction fees are used to buy back tokens. Heavendex's token, $LIGHT, is also involved in these buyback systems.

TLDR: Scarcity ≠ Attractive

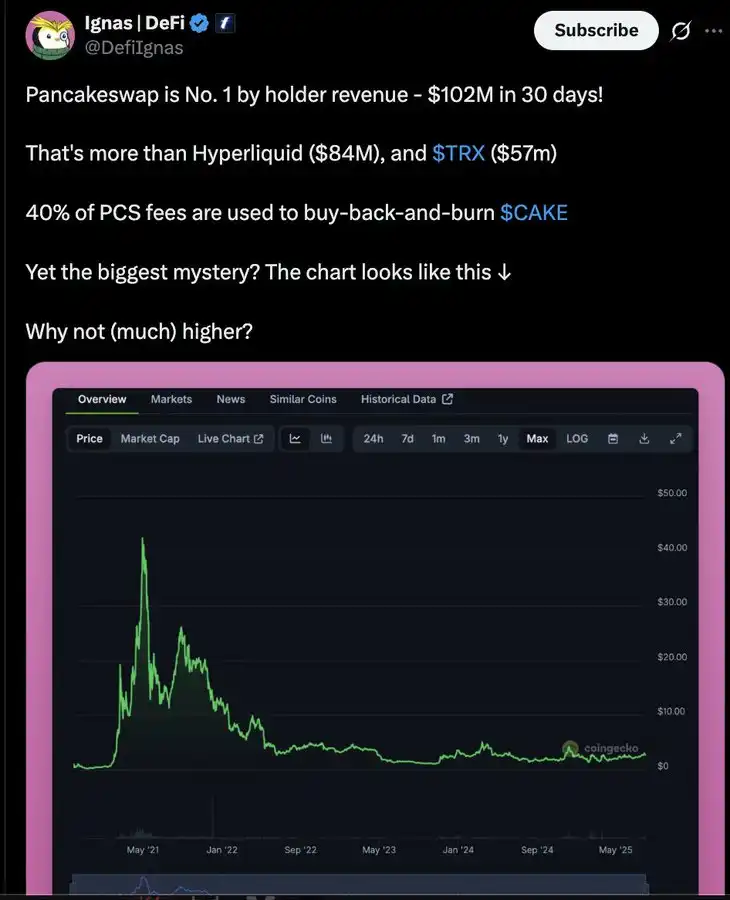

buyback tokens reduce supply. When supply decreases, people may think that demand will increase, driving up value. However, many cryptocurrency tokens do not have an inherent foundational need. Most of the demand comes from attention and cognitive share, which are often the main focus of most projects.

As the industry matures, projects with stronger fundamentals will make the buyback mechanism more effective in the long run. We have seen some projects start experimenting with the "flywheel effect" (protocol-level buyback mechanism) that aims to tie basic income to token value. It remains to be seen whether these attempts will be successful. At the same time, buybacks are often used to alleviate negative sentiment or create short-term price fluctuations, with mixed effects.

What exactly can token buybacks bring?

Before diving into buybacks in the crypto space, let's take a look at some cases of Web2 companies.

In traditional open markets, buybacks are typically used for the following purposes:

• Increase stock prices

, create scarcity

, reward shareholders

, and consume excess cash

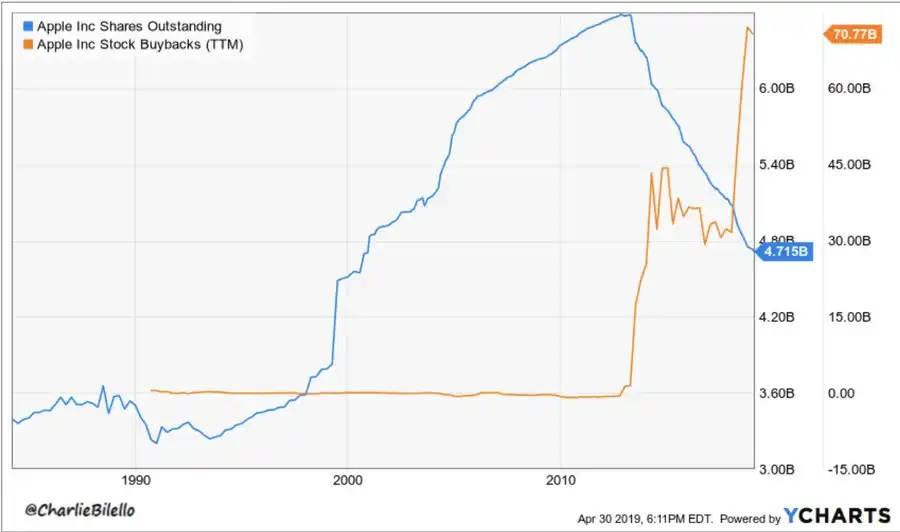

Apple is a typical example – since 2012, Apple has spent more than $650 billion on buybacks and reduced the number of shares by about 40%. The reason why this strategy worked was Apple's continued profit growth. In contrast, buybacks by General Electric (GE), IBM, or some oil giants have failed to stop stock prices from falling as the fundamentals of these companies gradually deteriorate.

– >

– >

reduced its outstanding shares by more than 50% through a series of aggressive programmatic buybacks from 2010 to 2019. During the same period, its stock price rose from $11 to $40 per share, a 300% increase.

Why are stock buybacks more signaling than token buybacks?

– Will >

– Will >

the crypto space start adopting earnings per share (EPS) as a way to assess token value?

Share buybacks directly increase earnings per share (EPS) by reducing the number of outstanding shares. Investors are very concerned about EPS and valuation multiples.

However, in the crypto space, there is no such thing as an EPS-like metric. Prices are driven more by attention, liquidity, and narrative than financial comparisons.

Additionally, programmatic buybacks in cryptocurrencies face a problem: revenue is cyclical, often fluctuating with bull and bear markets.

Founder's Buyback Decision Checklist: Should You Do a Repo?

Does your protocol have a steady stream of revenue? (Or are you consuming your capital reserves?)

Are your financial reserves strong enough to support buybacks without compromising growth?

Do you combine buybacks with fundamentals, such as product launches, partnerships, or user growth?

Are you aiming for price support or just to create a surface effect?

If the answer leans towards "surface effects," you may have just pushed an exit pull-up.

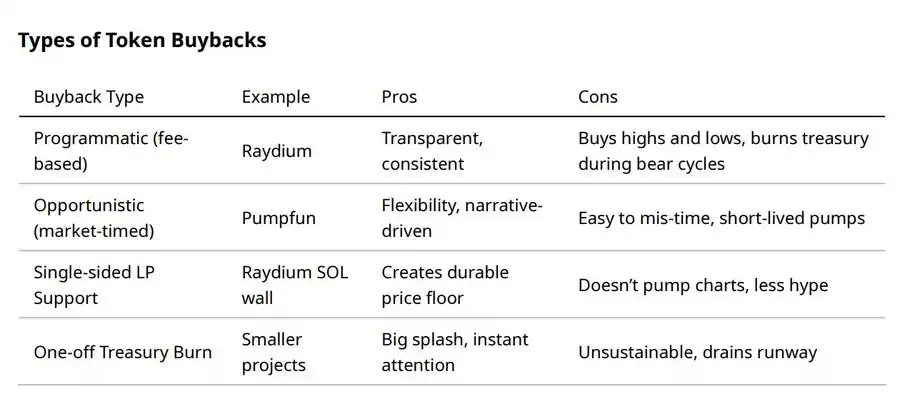

of token buybacks

Different buyback methods are suitable for different scenarios.

The whole process of the repurchase: before, during, and after

· Announcing the repurchase plan: Sometimes the market reaction only stems from the announcement of the repurchase plan ("early pricing" news).

Execution of buybacks: In some cases, the execution of buybacks can trigger a sell-off – providing exit liquidity for holders waiting to sell.

• Programmatic buybacks: Considered the best choice but volatile when revenue fluctuates cyclically. For example, Raydium has burned over $175 million in RAY, but its price still fluctuates with market attention cycles.

· Overpaying: If the buyback is executed at a high valuation, it will consume more capital reserves. Employing algorithms or volume-based weighting can help smooth out this process.

Case Study

: Hyperliquid ($HYPE): 97% of its decentralized exchange (DEX) revenue is spent on daily buybacks of approximately $3 million, with an estimated annual revenue of $650 million. With strong revenue and bold buyback programs, $HYPE is often hailed as the most successful buyback project. (The next question is, when or will the foundation be sold?)

$HYPE has asimilar buyback scale to Web2's Microsoft, with a market capitalization/fully diluted valuation (MCAP/FDV) buyback ratio of 82 times, and the annual buyback scale is very significant compared to the circulating supply.

· Pumpfun ($PUMP): On-chain buybacks and burns 118,351 SOL, triggering a 20% price increase, but the price fell within a day. Scarcity doesn't translate into attractiveness – rival BONK continues to grab the spotlight. (As of August 22, 2025, Pumpfun has regained market share leadership, but $PUMP has yet to react.) )

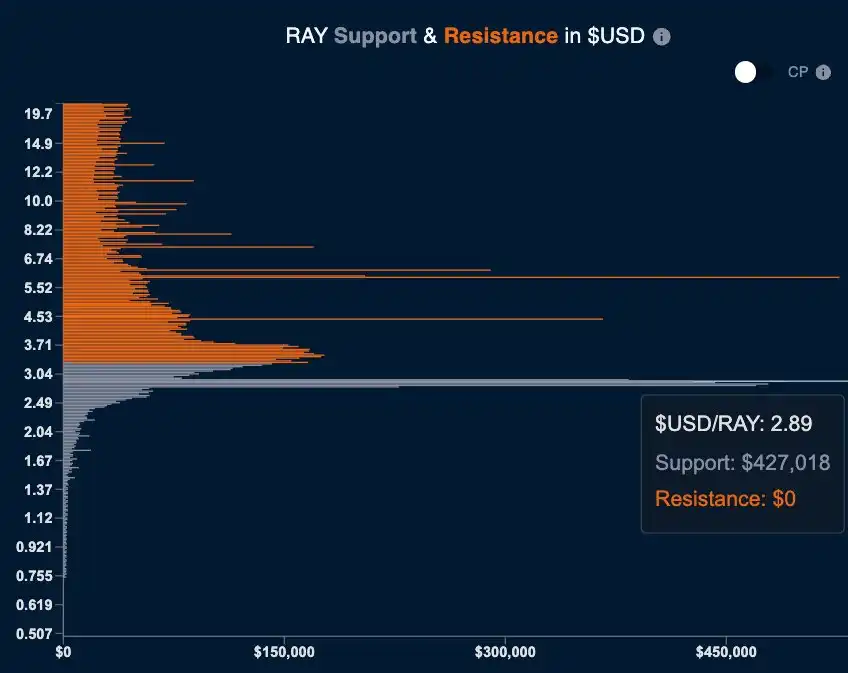

· Raydium ($RAY): Programmatic repo combined with a one-sided SOL liquidity experiment. The latter takes a healthier approach by creating price floors rather than chasing price increases.

Unilateral liquidity creates huge passive buybacks at the $2.89 price level.

· BNB Burn: The largest and most stable buyback/burn model in the crypto industry (programmatic burns based on centralized exchange revenue, cumulatively burning $35 billion in BNB). The success of this model is due to Binance's ability to generate billions of dollars in revenue annually through fees, providing sustainable financial support.

· MakerDAO Surplus Auction and Burn: Protocol revenue is used to buy and burn MKR.

– >

– >

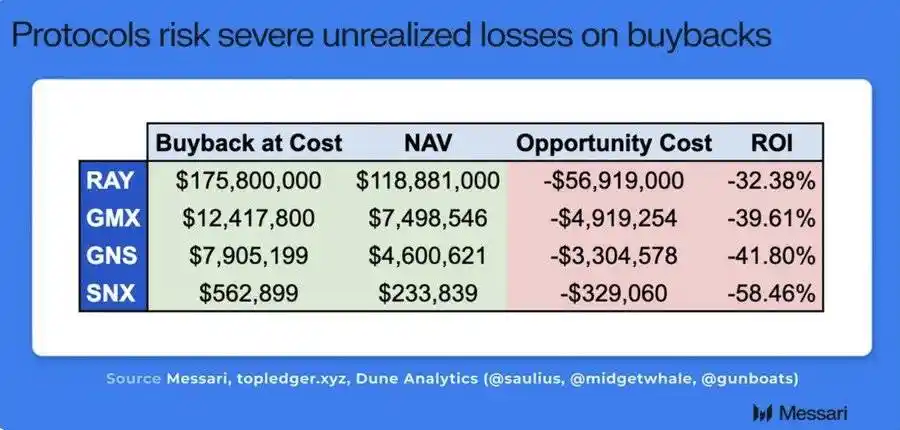

buybacks can become unprofitable due to market pullbacks, necessitating effective money management systems to optimize return on investment (ROI).

Investor perspective: Where does the money for repurchases come from?

Smart money looks at the essence through the surface. The strength and weakness levels of the repo signal are as follows:

· Supported by ongoing income → Strong signal

· Programmatic repo, linked to handling fees → Medium signal

· Opportunistic repurchase, supported by capital reserves → Weak signal

· One-time burn, draining capital reserves → Bearish signals

Buybacks backed by protocol revenue are positive signals, while buybacks that cut capital reserves are red flags.

– >

– >

For example, a manual buyback program for a Solana project with a fully diluted valuation (FDV) of $5 million (each orange line represents 0.5% of the total token supply to be repurchased). With buybacks, the project has increased its portfolio value by 4x and has used this growth to actively manage liquidity.

Three rules

buybacks 1. It must be supported by sustainable income (not a one-time reserve burn).

2. Must be combined with fundamentals (e.g., product launches, partnerships, or user growth).

3. It must be transparent and predictable so that holders build confidence and not sell in short-term price fluctuations.

Final summary: In the stock market, buybacks amplify fundamentals. In the crypto space, buybacks can create scarcity – but scarcity doesn't equate to attractiveness. Unless the protocol can build stickiness, ongoing revenue, and demand-side utility, buybacks are mostly narrative tools. Combining buybacks with real fundamentals, it can be a strong signal; If it is only used as a cosmetic effect, it will only help others to withdraw.

Other examples:

$RAY Buybacks and price action

$PUMP

$PUMP

Buybacks and price movements from July 17 to August 4

link to the original text